With enthusiasm, let’s navigate through the intriguing topic related to Deductions for Seniors Over 65: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

As individuals reach the age of 65 and beyond, they become eligible for various tax deductions that can significantly reduce their tax liability. These deductions are designed to provide financial relief to seniors who may face unique financial challenges, such as increased medical expenses and reduced income. This comprehensive guide will explore the different types of deductions available to seniors over 65, their eligibility requirements, and how to claim them on tax returns.

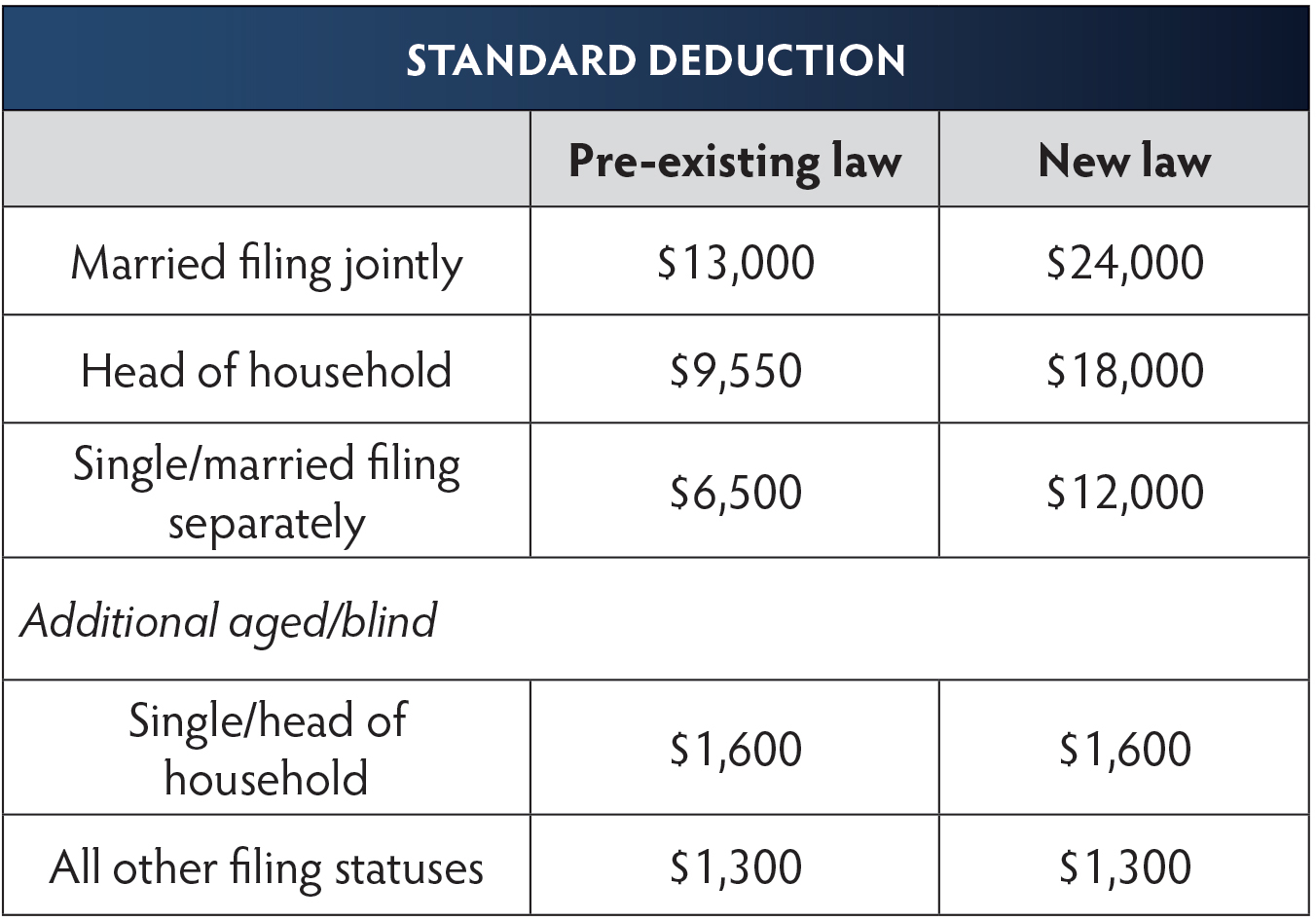

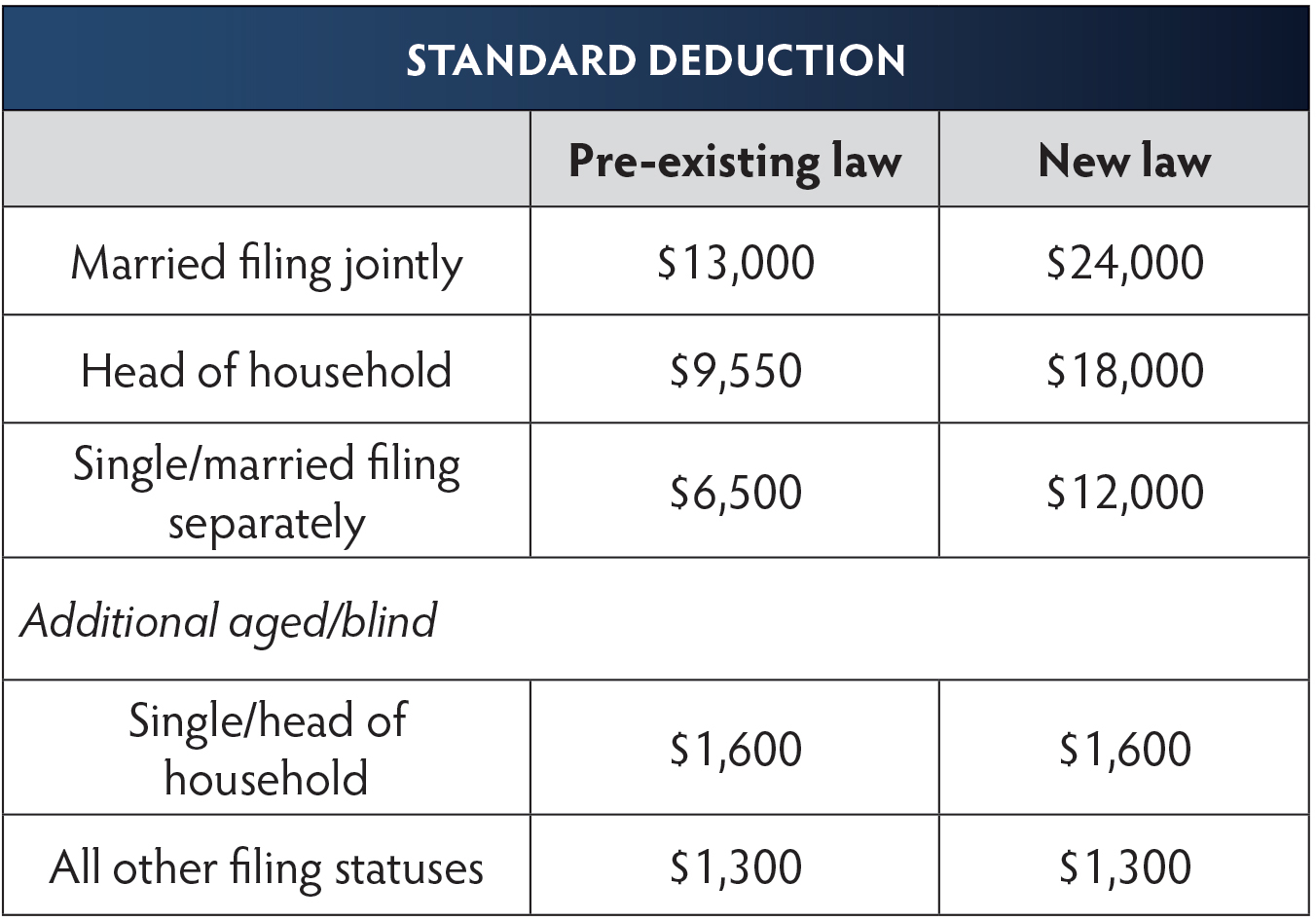

The standard deduction is a fixed amount that all taxpayers can deduct from their taxable income before calculating their tax liability. For seniors over 65, the standard deduction is higher than for younger taxpayers. In 2023, the standard deduction amounts are as follows:

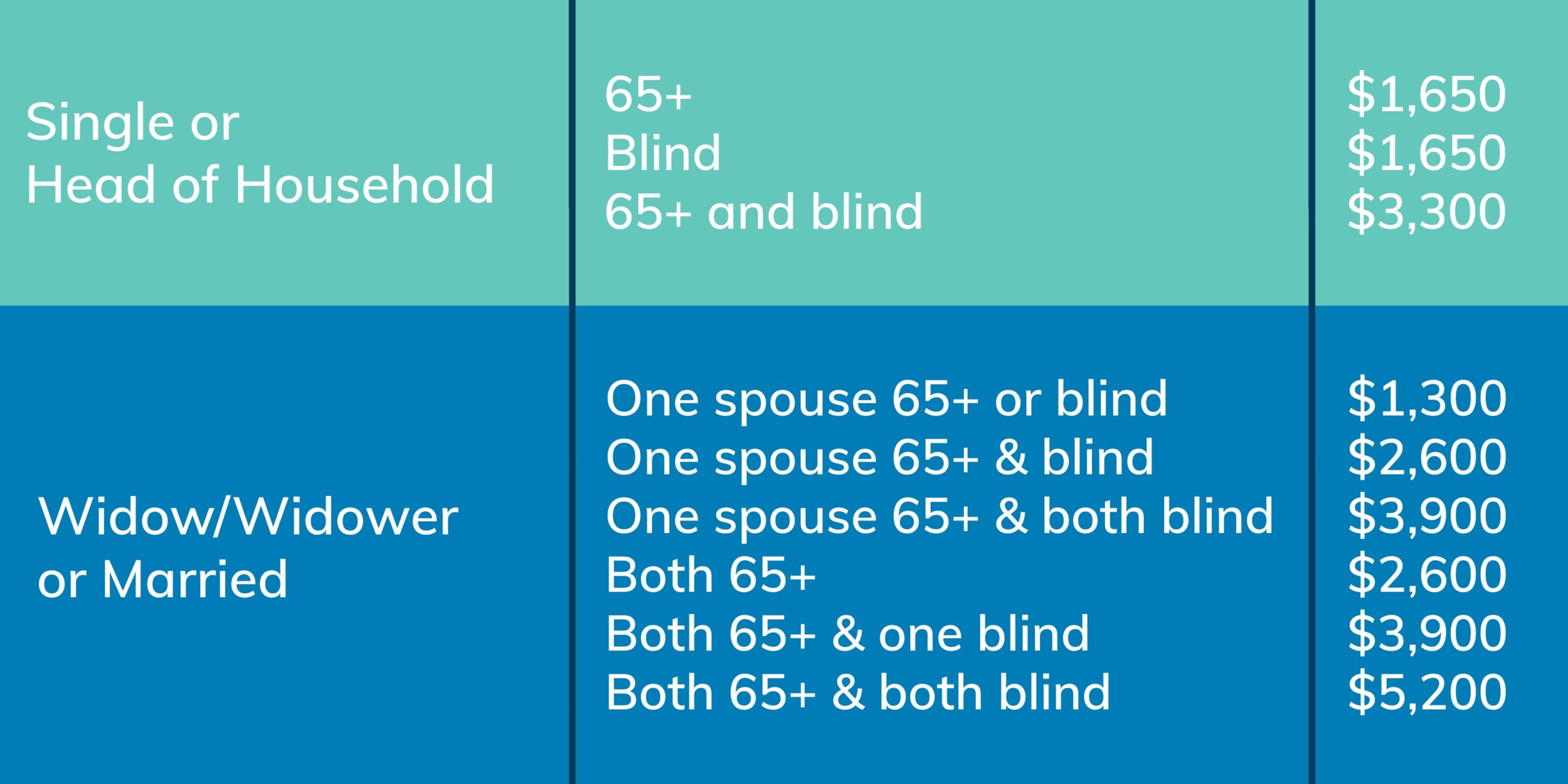

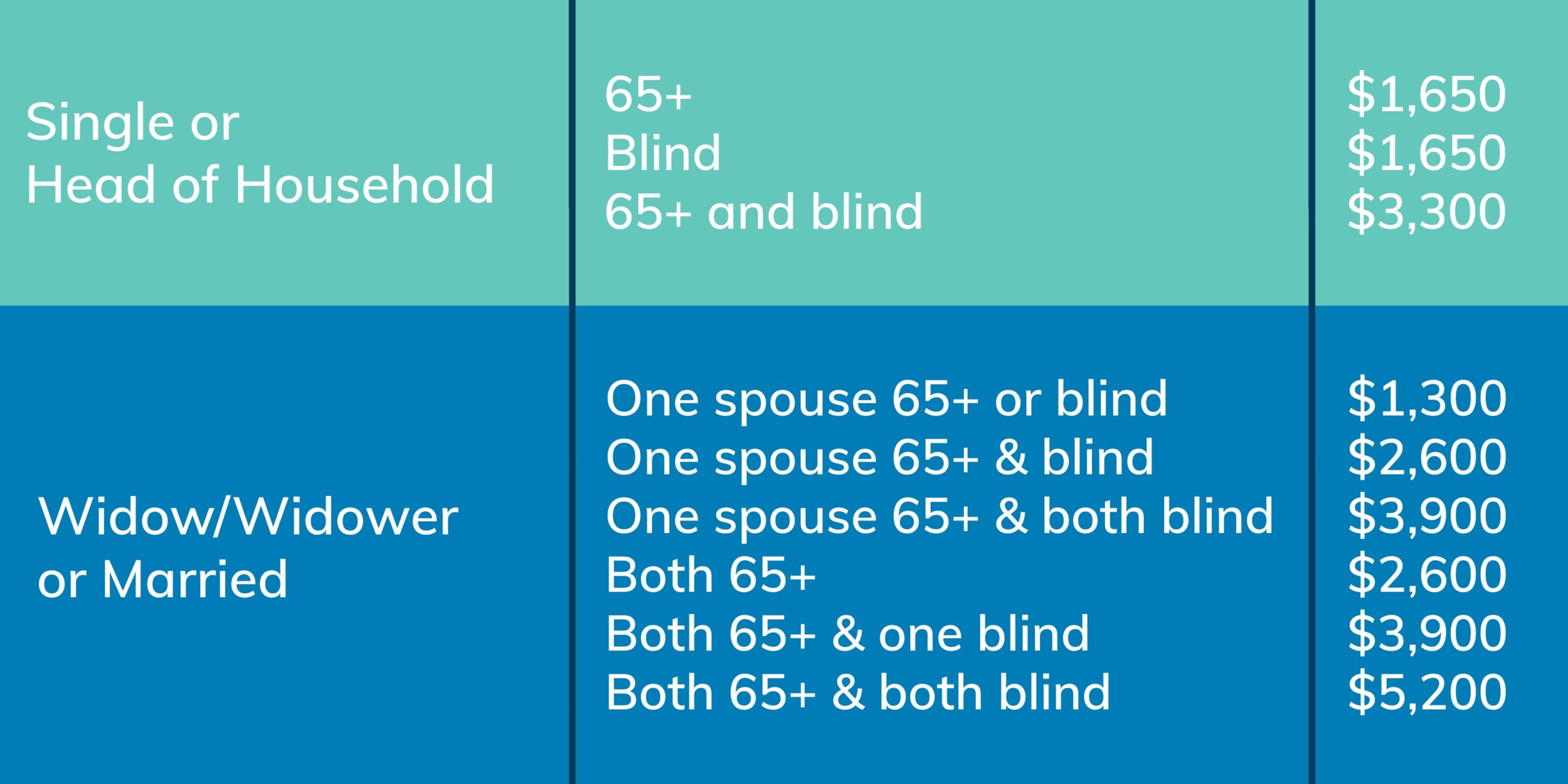

Seniors over 65 are entitled to an additional standard deduction of $1,350 (for 2023) if they meet the following requirements:

In addition to the standard deduction, seniors over 65 can itemize their deductions. This involves listing specific expenses that are deductible from their taxable income. Itemized deductions can include:

Medical and dental expenses are a significant expense for many seniors. Deductible medical expenses include:

To claim deductions, seniors over 65 must file a tax return using Form 1040. They can choose to take the standard deduction or itemize their deductions. If they choose to itemize their deductions, they must complete Schedule A (Form 1040).

Deductions for seniors over 65 provide valuable financial relief to individuals who may face unique financial challenges. By understanding the different types of deductions available and how to claim them, seniors can significantly reduce their tax liability and improve their financial well-being. It is recommended to consult with a tax professional or visit the IRS website for further guidance and assistance.

Thus, we hope this article has provided valuable insights into Deductions for Seniors Over 65: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!